As mentioned a sole proprietorship will not be taxed separately for its owner. How do I file taxes as a sole proprietor.

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie.

. Income tax return for individual with business income income other than employment income Deadline. As a sole proprietor you can help keep more money in your bank account as long as you do not require liability protection for your business. Basically this means you are the business and the business is you.

First 35000 Next 15000 8. In Malaysia there are three different laws governing the registration and administration of sole proprietors- Heyuu West Malaysia and the Federal Territory of Labuan. These benefits of starting a sole proprietorship business in Malaysia are quick and easy registration no corporate tax payments lowest manual maintenance less formal business requirements easy winding process and more.

15 rows Sole proprietorships in Malaysia are charged the income tax on a gradual scale applied to. Should the owner ever decide to expand there is always the opportunity to change the business to either a partnership or a private. Sole proprietor partnership corporation Federal Government State Government statutory.

Additional RM500 a year for each branch registered and RM1000 excluding SST for business information print-out. Principles of Naming a Business. Sole proprietors are required to complete two forms in order to pay their federal income tax for the year in question.

May 2016 Produced in conjunction with the. To register a sole proprietorship in Malaysia the following criteria must be fulfilled. In Malaysia there is no distinction between the natural person who owns the sole proprietorship and the business that is operated by that person.

First 70000 Next 30000 21. Whatever you pay yourself either in the form of remuneration allowances or benefits such amounts are not tax deductible in arriving at the statutory income from the sole proprietary business. The lower cost for setting up the company.

The lower amount of paperwork. Additionally setting up a sole proprietorship still allows an opportunity for the business to grow. A sole proprietorship is held entirely by a single person who uses their personal name identity card or trade name.

All business income received by the business owner must be declared in the personal tax filing. In Malaysia what exactly is a sole proprietorship. She will be paying RM 31300 in income tax for YA 2021 and its calculation is.

30062022 15072022 for e-filing 6. Sole proprietorship Malaysia comes with enticing policies where the owner of the company doesnt need to corporate tax. Income tax filing for sole proprietors is straightforward.

Second there is Schedule C which contains information on the companys profit and loss. Income tax return for individual who only received employment income. First 50000 Next 20000 13.

As a sole proprietor on the other hand youre responsible for 100 of these taxes. Similar to sole proprietorship a partnership is also governed by Companies Commission of Malaysia abbreviated SSM Suruhanjaya Syarikat Malaysia and Registration of Businesses Act 1956. If Janet Remains a Sole Proprietor.

A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956. First 20000 Next 15000 3. A single owner is regarded as the same.

Sole proprietorship From the tax perspective there is no separation between you as an individual and you as a sole proprietor. Even though businesses have been registered with SSM business owners are responsible for. RM 6000 a year.

Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. 2 Income Tax Treaties for the Avoidance of Double Taxation 5 3 Indirect Tax 7 4 Personal Taxation 8. To do this you will need to register your new business at a local SSM branch.

Only the owner is allowed to apply. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. However unlike a sole proprietorship a partnership is normally owned by two partners and not exceed twenty 20 partners at one time.

To start with first lets calculate Janets income tax payment for YA 2021 if she succeeds in attaining as much as RM 250000 in PBT as a sole proprietor in YA 2021. Sole proprietors file fewer tax forms and spend less in startup costs than other types of enterprises. In Malaysia a.

How much is the tax for a sole proprietorship in Malaysia. Business is owned by two 2 or more persons but not exceeding 20 persons. The tax rate ranges from 2 26.

As previously stated states require LLCs and other business. Annual auditing is less complex and doesnt require separate company secretary. The overall simplicity of execution.

Theres the Form 1040 which is the individual income tax return which is the first step. Income tax return for partnership. First 5000 Next 15000 1.

The owner must be a Malaysian citizen or permanent resident of Malaysia. Income tax return for companies. 30042022 15052022 for e-filing 5.

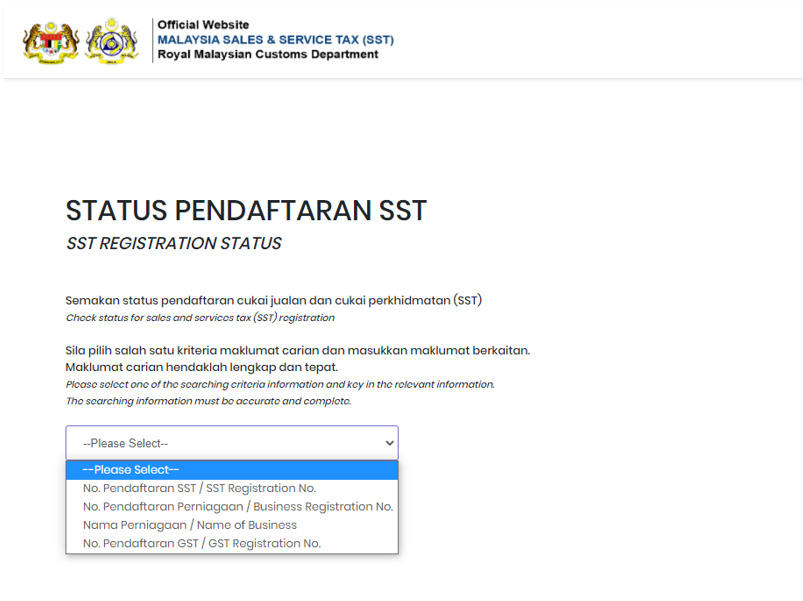

As a result one of the most significant benefits of running a business as a sole proprietor is the ability to save money on registration fees. Goods and services tax GST Sole proprietors must register with the Royal Malaysian Customs Department to charge and collect goods and services tax GST once their taxable. Unlike a corporation a sole proprietorship is not a separate entity from the person who owns it.

Lembaga Hasil Dalam Negeri LHDN Inland Revenue Board IRB who you pay your taxes to and where you register for tax filing. The cost evaluation is marginal and way lower when compared with other form of business in this nation. Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form C.

These taxes are referred to as self-employment taxes and. You then need to name your sole proprietorship either as your personal name or a business under which you trade. Tax rate Tax RM 0 5000.

The owner must be aged 18 years and above. How is Sole Proprietorship taxed in Malaysia. Form C refers to income tax return for companies.

Suruhanjaya Syarikat Malaysia SSM Companies Commission of Malaysia CCM where you register your LLP get its birth certificate and do your annual declarations. The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia.

Everything You Need To Know About Singapore Private Limited Company Registration Private Limited Company Singapore Company

What Salary Makes You Eligible For Paying Income Tax In Malaysia Income Tax Salary Income

Wholesale Retail Trade Wrt License In Malaysia Malaysia Small Business Ideas Export Business

Accounting Malaysia Importance Of Financial Statement By Beyondcorp Financial Statement Accounting Financial

How To Apply For Online Company Registration Private Limited Company Limited Liability Partnership Aadhar Card

Malaysia Percent Of Firms With Legal Status Of Sole Proprietorship 2022 Data 2023 Forecast 2007 2015 Historical

Accounting Service In Ghana In 2021 Accounting Services Accounting Accounting Firms

Successful Businesses In Malaysia Success Business Malaysia Business

Solution Corporate Tax Studypool

Malaysia Sst Sales And Service Tax A Complete Guide

Company Super Form Malaysia Malaysia Company Make Business

Company Super Form Malaysia Malaysia Company Make Business

New Company Registration In Malaysia Enterslice Public Limited Company Private Limited Company Limited Liability Partnership

Registering An Enterprise In Malaysia Enterprise Success Business Consulting Business

Meaning Of Accounting Services Accounting Services Accounting Bookkeeping And Accounting

Form 2290 E Filing For Tax Professionals Irs Forms Irs Employer Identification Number

Types Of Visa In Malaysia Malaysia Small Business Ideas Visa